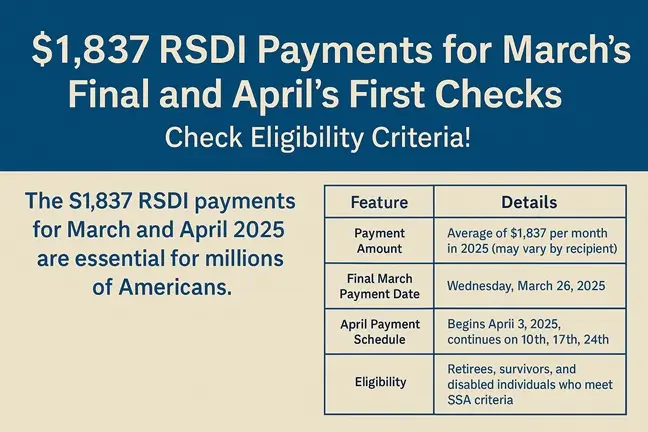

RSDI Payments for March and April 2025: As Social Security recipients enter the second quarter of 2025, many are asking: Who qualifies for the $1,837 RSDI payments in March and April? With inflation and cost-of-living adjustments (COLA) remaining a concern, understanding RSDI eligibility, payment dates, and benefit amounts is essential.

What Are RSDI Payments?

RSDI stands for Retirement, Survivors, and Disability Insurance, a key federal benefit program administered by the Social Security Administration (SSA). It covers three categories of Americans:

- Retirees aged 62 and above with qualifying work credits

- Survivors of deceased workers, including spouses and children

- Disabled individuals who are unable to engage in substantial gainful activity

In 2025, the average RSDI benefit is $1,837 per month, although the actual amount may vary based on lifetime earnings, age at claim, and disability status.

March’s Final RSDI Payment Date: Mark Your Calendar

March’s final RSDI payment will be disbursed on Wednesday, March 26, 2025.

This payment goes to:

- Beneficiaries born between the 21st and 31st of any month

- Individuals who started receiving benefits after May 1997

If you fall under this category, your payment will be made either via direct deposit (recommended) or by paper check, which can take longer.

April 2025 RSDI Payment Schedule

Here are the confirmed April RSDI payment dates:

- April 3, 2025 (Thursday) – For beneficiaries who began receiving Social Security before May 1997

- April 10, 2025 (Thursday) – Birthdates 1st–10th

- April 17, 2025 (Thursday) – Birthdates 11th–20th

- April 24, 2025 (Thursday) – Birthdates 21st–31st

The SSA recommends waiting three business days before contacting them if your payment is late.

Who Is Eligible for the $1,837 RSDI Payment?

The $1,837 is the average monthly RSDI amount in 2025. However, to be eligible, you must meet the SSA’s requirements under one of the following:

- Retirement: Age 62+ with 10+ years of covered earnings

- Survivors: Immediate family members of a deceased qualifying worker

- Disability: Those meeting SSA’s strict definition of total disability

Use the SSA Benefit Calculator to estimate your personal monthly benefit based on your earnings record.

Why Do RSDI Payment Amounts Differ?

Several factors influence how much a person receives:

- Lifetime earnings history

- Claiming age

- Type of benefit (retirement, disability, or survivor)

- Number of dependents

How to Make Sure You Receive Your Payment on Time

To avoid delays or missed checks, follow these steps:

- Use Direct Deposit

- Keep Your Information Updated

- Monitor Your Benefits via My Social Security Account

- Report Missing Payments to SSA if delayed by more than 3 business days

Quick Reference Table

| Feature | Details |

|---|---|

| Payment Amount | Avg. $1,837/month (varies) |

| Final March Payment | March 26, 2025 |

| April Payment Dates | April 3, 10, 17, 24 |

| Eligibility | Retirees, survivors, disabled |

| Payment Method | Direct deposit or paper check |

| SSA Resource | SSA.gov payment calendar |

FAQs RSDI Payments for March and April 2025

Q1. What does RSDI stand for?

RSDI stands for Retirement, Survivors, and Disability Insurance — a federal Social Security program.

Q2. Who gets the $1,837 payment?

That’s the average monthly RSDI benefit in 2025. Actual amounts vary based on earnings and claim age.

Q3. When is the final RSDI payment for March?

Wednesday, March 26, 2025, for beneficiaries born between the 21st–31st of any month.

Q4. How can I avoid delayed payments?

Use direct deposit, keep your SSA info updated, and monitor your My SSA Account regularly.

Q5. Can someone receive RSDI and SSI together?

Yes, if they meet both program requirements. RSDI is earnings-based, while SSI is need-based.

As a finance news writer at sirfal.com, I specialize in breaking down complex economic trends, market updates, and investment strategies into clear, actionable insights. My mission is to empower readers with the knowledge needed to make informed financial decisions. Thank you for engaging with my articles; I hope they add value to your financial journey.